Homelend is a decentralized platform that enables the next generation of home equity financing. Homelend provides an interface for direct interaction between borrowers, lenders and other parties involved in the mortgage value chain. In this way, mortgages allow crowdfunding with a peer-to-peer model with the security, transparency and automation of distributed ledger technology (DLT) and smart contracts. Homelend is currently launching an ICO to raise capital to support our project. Our offer is made by Zug, Switzerland (aka Crypto-Valley), under the highest standards of security and trust.

About Homelend

From manual and tedious to streamlined and efficient

By embedding pre-defined business logic into smart contracts, digitizing documentation and eliminating unnecessary processes, Homelend automatically performs an end-to-end creation process, reducing it from 50 days to less than 20 days.

From Ambiguous & Clunky to Transparent & User

Friendly Homelend aims to create a credit process that is not only smart, but also simple and fair. It will allow borrowers to apply for a loan easily, keep track of their status at any time and get in touch with lenders directly.

From Costly Intermediation to Cost-Effective & Middleman-Free

The immutability, security and transparency offered by DLT enables the capture of transactions, including loans, without banks acting as intermediaries. This will lower the costs for borrowers and lenders while minimizing the distance between them.

From vulnerable to unreliable to trustworthy and secure

Centralization and paper-based processes are the key factors behind the uncertainty and vulnerability that characterizes the traditional mortgage industry. The unique features of DLT and Smart Contracts enable Homeland to provide people with a platform where they can make large amounts of money confidently, transparently and securely.

The big financial crisis of 2008 started with problems in the real estate and mortgage industry. It shocked the whole world, erased millions of jobs and threatened to destroy the entire banking system. In the end, the states intervened and with more or less success, and a large number of mistakes made during the process somehow managed to stop the crisis, and the world slowly began to recover. The problem is that almost the entire banking, real estate and mortgage business has stayed the same, so we can even expect a bigger financial crisis in the future. To prevent that, we need to change the crux of the problem - the way banks carry out mortgage credit.

With the development of blockchain technology, we now have tools to change that and revolutionize the mortgage industry with [HOMELEND] ( https://homelend.io/ project).

At its core, Homeland is a decentralized peer-to-peer mortgage lending platform designed to address major industry challenges and revolutionize the mortgage industry. Homelend uses two of its most effective segments, Blockchain Technology, Distributed Ledger and Smart Contracts, to establish a direct connection between lenders and individual borrowers from around the world. Both sides in the Homeland ecosystem will benefit from this platform. Lenders have a faster and less expensive method of being able to access required funds at a much lower interest rate by connecting directly to a borrower from the platform. On the other hand, borrowers have direct access to many new clients.

The primary goal of the Homelend team was to create a secure, transparent and user-friendly platform that effectively connects two sides in the mortgage lending process. The whole process is accelerated and takes less than 20 days. Even if the intermediary (bank) was removed from the home-country ecosystem, mortgage borrowing became less expensive and more efficient, and security remained at the highest level. Thanks to the blockchain technology, all transactions are recorded and can not be altered or falsified in any way.

It is good to underline that the $ 31 trillion mortgage market is one of the largest and most profitable markets in the world. If you take only a small part of this market, every company would be successful and highly profitable, and Homelend has done everything for it. If the team delivers everything from its roadmap, we could expect the Homelend platform to be launched in one year and fully functional.

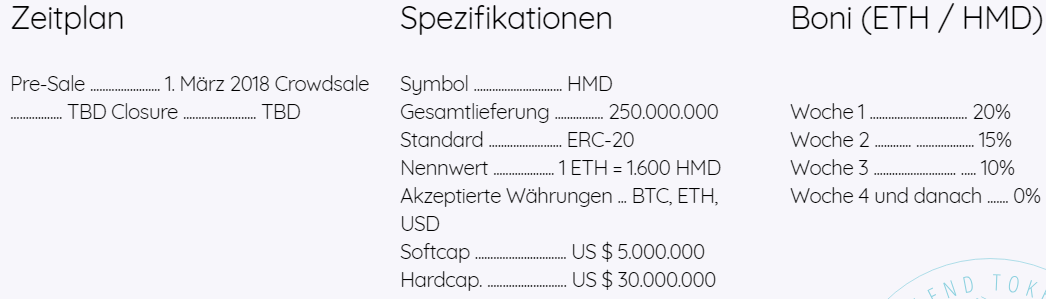

Homelend organizes ICO to finance its future development. Homelend tokens are used for all services and fees on their platform. Basic ICO Information:

Zeichen HMD

Preis 1 ETH = 1600 HMD

Kopfgeld Verfügbar

MVP / Prototyp Verfügbar

Plattform Äther

Akzeptieren BTC, ETH, Fiat

Minimale Investition 1.000 USD

Weiche Kappe 5.000.000 USD

Harte Kappe 30.000.000 USD

Land Schweiz

Weiße Liste / KYC KYC & Whitelist

The Homelend Token (HMD)

The HMD token is the fuel for the homeland peer-to-peer lending platform. Its main functionality is access to the Homelend platform.

This utility token also plays a crucial role in enabling a fast, smooth, and easy-to-use workflow that is consistent and secure.

All tokens can be converted to and from HMD.

My Bitcointalk : erwin_ibrahim

0 Comments